Preface

Today we will use Pattern Finder to identify bullish chart set-ups, where the upside target zone has more room than the downside zone target zone.

But this time, we will incorporate our new free ChatGPT powered tool for real-time sentiment analysis.

This tool will be upgraded rather substantially (like… a lot…) in the next few weeks and then integrated into Pattern Finder and TradeMachine so traders can do this analysis on the fly, themselves.

For now, Pattern Finder is quite inexpensive and you can learn more about it and receive special pricing here, or read this post to the end, and then access it again at the end.

Bullish Charts and Bullish Sentiment

We start with the the “Directional Charts” screens in Pattern Finder, as our analysis generally starts from that perspective.

The first screen we look at is the “Bullish Charts; 3-yr Charts; Nearest Congestion or Trend” and we see several tickers including some big names.

Let’s start with AMZN and the 3-year chart. As always, we enable Pattern Finder to draw in all the goodies:

Trend resistance as a green line.

Trend support as a red line.

Congestion as pink lines.

Target upside and downside zones in green and red shading.

Any CANSLIM patterns.

It’s clear where Pattern Finder’s algorithms are making the decision that this stock belongs in the 3-year bullish screen category as it marks up the chart.

Pattern Finder sees the next upside target as the prior double bottom, which is about 12% higher, while the downside target would be the shelf o that prior gap down.

We can zoom in a bit to see that dynamic closer:

Alright, next we turn to our newly released AI driven sentiment algorithm from our free tools.

And we get this answer:

The sentiment for AMZN is neutral 5. The news headlines for AMZN are mixed, with some positive and negative news.

On the positive side, analysts predict that Amazon may catch up on the AI stock surge, and the company is expanding in the UK with WeWork space for 1,000 staff. Additionally, Amazon beat all 18 shareholder-led proposals at its annual meeting.

On the negative side, Warren Buffett sold Amazon stock in Q1, and the company was left out of the Nvidia bump for AI and cloud plays.

There were also reports of tech layoffs ravaging the teams that fight online misinformation and hate speech, and delivery drivers suing Amazon for being forced to pee in bottles. Overall, the news for AMZN is mixed, resulting in a neutral sentiment.

So, the sentiment is neutral, though the chart is strong.

(As a side note, wow that’s good context for a first version. Congrats to our dev team and especially our CTO.)

We are (literally) improving the sentiment algorithm right now, so as you check it out, it may change a bit.

Next, we turn to a stock from a similar scan “Bullish Charts; 3-yr Charts; Trend Support and Resistance Lines” but also has positive sentiment.

We get ticker CRM and find one of our favorite set-ups; what we refer to as “walking up support.”

This pattern forms when a stock has a series of higher lows that form a rising support line.

Here is the 3-year chart for CRM:

Pattern Finder identifies the near-term downside risk but also extrapolates a trajectory of continued upside “support walks”.

We can zoom in to see that phenomenon:

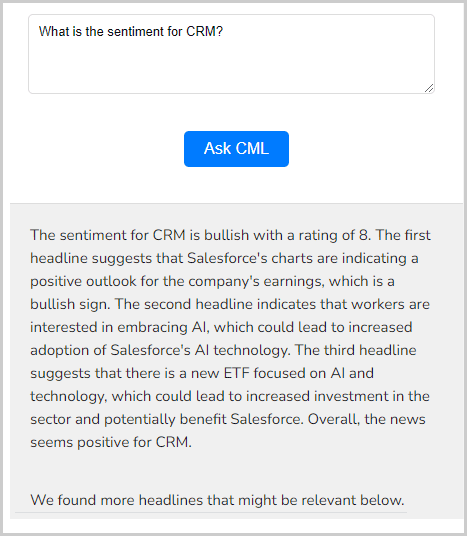

As for the sentiment, we get this:

We do note that CRM reports earnings on 5-31-2023 after the market closes, so there is an embedded sort of “coin flip” that could go either way soon.

Next we turn to the “Heavy Buying Volume” screen from Pattern Finder, which looks at buying volume versus selling volume over the last 30-days.

We pluck out ticker NOW and share the 3-year chart below.

Note that the stock has broken through congestion formed by the top of two cups and the target upside zone would be the prior double tops.

We can zoom in for clarity and then turn to sentiment:

And here is the sentiment from our CML-GPT tool:

This is one with a reasonable chart, but certainly not obviously bullish, that has heavy buying volume in the last month (relative to selling volume), has a “Buy-Sell Rating” of 91/100 (our proprietary buying strength model) and a 3-month RS of 93/100 along with that positive sentiment.

Lest we forget what algorithms already exist in Pattern Finder!

Alright, we’ll keep it short today.

Hopefully it’s quite clear how you can replicate this analysis on your own and the weekend can be a great study time for the next week.

We also want to share our gratitude and recognition for those that we will honor on Memorial Day in the United States this Monday.

Conclusion

Our goal today was to incorporate our new capabilities in artificial intelligence together with our algorithmically powered charts and screens from Pattern Finder.

Progress will not slowdown, and what is considered acceptable today will be unacceptable in the future - the table stakes have been raised and it’s not just in finance.

The final AI powered sentiment we will publish, coming in a few weeks with many other truly massive upgrades to Pattern Finder and TradeMachine, will include volume sentiment analysis, and multi-time period sentiment - not just a month, but a look back window and two sentiment scores.

We’re really enjoying pushing the envelope and each day we make what feels like a month of progress. For example, that sentiment indicator from above was created in the last 20 hours.

Pattern Finder and TradeMachine (option backtester) will both be upgraded rather substantially in the coming weeks and months with advanced versions of this AI that will not be available on our free free website.

That will be sentiment, but also tail analysis for option traders to scalp option volatility, alpha (as in, actual alpha from the CAPM model) identification and just a lot more.

This will then all be put into Pattern Finder and TradeMachine so traders can do this analysis on the fly, themselves, with an advanced version.

The price of Pattern Finder will go up once we make all of these various AI driven updates that we have discussed for the last few weeks.

We’re not kidding when we say that.

But, you can get it with a locked in price here: Pattern Finder Discount

Similarly, you can go the super advanced route with options with TradeMachine, here: TradeMachine Discount.

Thanks for reading, friends.

CML has an amazing team and leader and thanks for your continued mentorship