Bullish Charts; Bearish Charts; Unusual Live Intraday Early Volume; 11 Charts.

Lede

Today we will continue our normal path of sharing bullish and bearish charts.

We add some flavor to today’s post with unusually heavy bullish and bearish volume (intraday screens) as well, extrapolating the early morning trade into a full day. The goal with the last two screens is to catch movers early.

We also add a breakdown through trend support using the ‘Pattern Breakouts’ tab.

For bullish directional charts today, we’ll start with a focus on a certain flavor - the bullish charts walking up support.

Please remember that everything you see here - every chart, mark up, and screen, is automatically done for you in Pattern Finder.

Bullish Charts

Pattern finder identified several stocks that are walking up support on the 3-year chart.

Rising trend support occurs when there are higher lows, so we are forcing Pattern Finder to show us charts in an uptrend with higher lows.

These come from the “Bullish Charts; 3-yr Charts; Trend Support and Resistance Lines” screen. We show four charts, the rest is for members to check out on the platform.

We’ll show one tactical chart as well with congestion lines (pink) and CANSLIM patterns turned on as well that is breaking through trend resistance (green line).

This is an attempt to identify an early breakout so the move as of today has not been confirmed with a clear high volume breakout. We call this a “maybe bullish - risk lover special.”

Is that a new breakthrough? Your level of risk aversion will answer that for you.

Another great chart is GFI. It appears to have broken out of a long cup, and now the PnL zone shows more upside potential than downside risk. (This is all probabilities, not a panacea.)

Heavy Bullish Volume

We’ll look at BABA, which released news that it would focus on six business segments and perhaps IPO each one of them individually. Here is the 18-month chart with daily candles.

Now that is quite the move on daily volume (extrapolated) to over 10x the 30-day average.

Ticker WB is another one that you can check out with early heavy bullish volume.

We use this screen in Pattern Finder to identify these names:

Bearish Charts

We can look at bearish charts as well:

For this first chart, focus on the PnL zones, where there is more room to the downside than the upside:

Next we turn to the ‘Heavy Bearish Volume’ screen - the intraday screen and find a gapper.

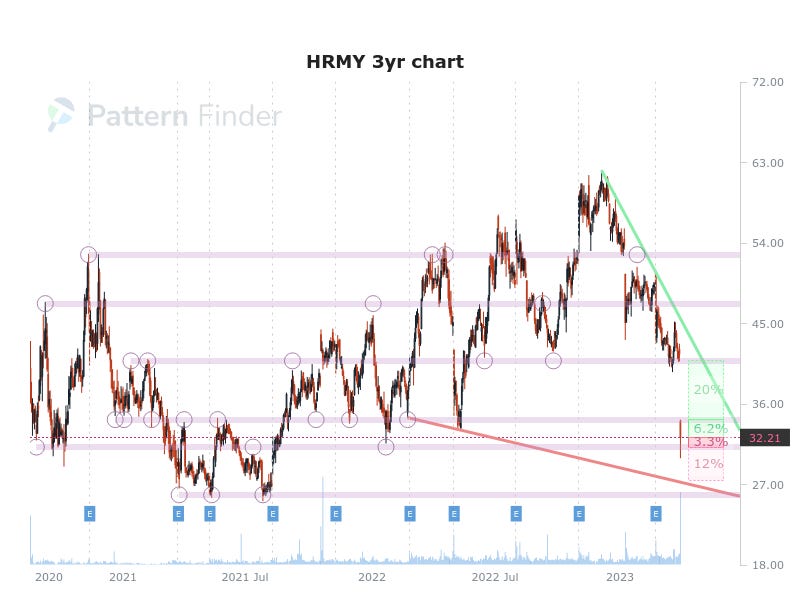

HRMY is seeing daily volume (extrapolated from the first hour) at 40x the 30-day average.

FUTU is another from this screen - down off of earnings and a classic lower highs down sloped trend resistance (green line), which is automatically drawn in by Pattern Finder.

The 18-month chart shows the PnL zones more clearly as well as the large candle today.

Finally, we look at a breakdown through support using the “Pattern Breakouts” tab.

Here is the CFB chart:

Conclusion

Buckle up for volatility - that’s how SPX reads, and buckle up for downside pressure in the Russell 2000 from our prior post.

To profit in this world, two sided trading may be required. That’s bullish and bearish.

CML Pattern Finder is the answer. Transform a standard stock chart into a trading plan — instantly.

You have to experience it to believe and experience is just a free click away through a video below.

If you want to join as a member, it’s less than $1 a day.

We are offering a huge discount on this page: Pattern Finder: The Next Era of Charting.