Lede

Today we take the next step forward from our prior post, Finding the Best of the Best, and extend it to a screen which is almost complete.

We start with the stock charts we would have wanted to find so to know what we’re looking for, and then create a scan which identifies them before the stock move is complete.

We leave the screen 75% complete, with the final part coming to Pattern Finder in the next 4-6 weeks; and it’s a big deal.

Charts - The Ones We Would Have Wanted

Without revealing the screen (yet), here are stock moves in a few charts that are what we would have wanted to find before the fact.

We start with a 3-year chart of ticker BMA, and since substack (this newsletter platform) does limit the size of these posts, instead of showing the full chart and then below it the zoomed in portion, we included the zoomed in portion on the top of the longer-term chart.

Note the quick gap move up through resistance (the green line) and congestion (the pink lines).

BMA crossed above trend resistance (the green line) and did so on strong buying:selling volume; in other words, up days had significantly stronger volume than down days.

The result was a rip through resistance and all prior congestion.

Next we turn to SCCO, a similar chart with the same volume characteristics, and further, where the short-term 3-month RS is very strong (greater than 80 out of 100) and larger than the 12-month RS.

The result is another “if only we would have known” chart and a punch higher. The zoomed in portion is on the bottom of the chart.

And the last example of what we would have wanted to find is for ticker ACLS. A rip above trend resistance and through all congestion.

Now we go deeper.

The Screen

I didn’t flip through charts until I found the big moves, rather I built a screen of what should have produced these charts.

This screen is mostly done, but not completely done.

Here is the screen and the number of stocks that qualify for each step.

This left us with 24 stocks, and each of the prior three charts above came straight off of this screen.

Specifically the screen requires short-term RS to be above 80 (out of 100), to be above the long-term RS, and to have positive stock returns over the last 4-weeks and 1-year.

It requires the buy volume (volume on up days) to be at least 130% that of sell volume in the last 30-days and at least 110% in the last 50-days.

On the fundamental side, we require positive free cash flow, an operating margin above that of the industry median, and at least $100 million in revenue.

Finally, we require our proprietary ‘Buy -Sell Rating’ to be to be at least 80 (out of 100; Pattern Finder members can read the inputs of that rating by clicking on the ‘?’ next to the metric in the screener or simply go to the help tab).

Now we turn to some charts that are also from this screen, but might be in the earlier stages of the moves that were realized in those three prior charts.

Charts - Potentially In Progress

We start with ORCL and the 5-year chart using daily candles.

Pattern Finder draws in the trend support (red line), trend resistance (green line), and all of the congestion lines (pink lines).

We then zoom in and drew in the loss zone (down to the nearest congestion line) and the profit zone (up to the peak in late 2021).

This has a larger profit:risk zone (green box is larger than the red box), but what we really wanted was this upward move - that climbing series of higher lows which formed (automatically) trend support.

We zoom in on the 3-year chart and can see how the stock climbed the support ladder.

ORCL may be a nice set-up and has some well defined profit and loss zones.

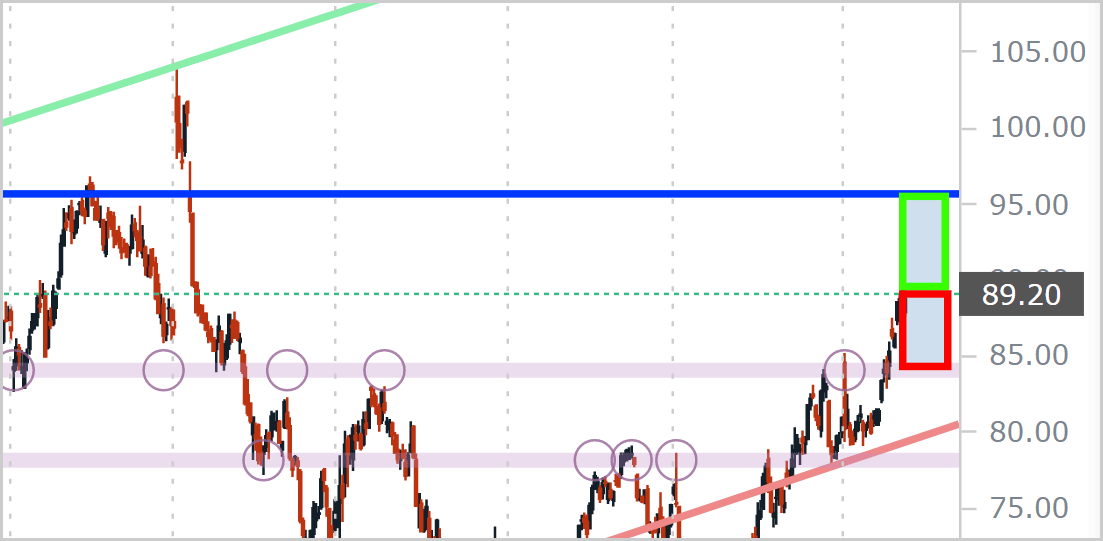

Next, we turn to PDD and the 3-year chart, with a zoom at the upper right hand side.

As we would have hoped, the stock climbed over resistance (green line) and has paused at the next congestion line.

A loss zone could be drawn back to prior resistance and the profit zone could be drawn at the next congestion.

Next we turn to VIPS, a 5-year chart with the zoom on the upper right hand side.

It’s a beautiful break above support (red line), again with the volume and relative strength characteristics that we want.

If we zoom in further, we can see that the stock broke through an immense wall of congestion lines, crossed above support, and is at a potential breakout.

There is a set of stocks that is somewhere in between the top three, which experienced the large moves, and the next three, which could be at the beginning stages.

The curious trader may want to see these “halfway” breakouts. Here are the tickers:

AU, BHP, FOUR, THE

Conclusion

The screen isn’t complete. We need to be able to add chart positions to the other metrics; things like distance to support, distance to resistance, and distance to and from congestion lines.

Then we want to find those where the potential profit zone is larger than the loss zone by using these distances to each crucial point.

Those distances are measured to lines, and those lines come from one place and one place only: Pattern Finder’s algorithm.

We will soon add these to our screener and send emails several times a week to Pattern Finder members with the breakouts and the charts, and may even add a “Today” tab, for those stocks that satisfy these requirements on the day in real-time.

It’s a good time to be a short-term trader, and it’s even better if you can do it with Pattern Finder.

We truly hope you are enjoying using Pattern Finder and our posts and see how easy it is to improve your trading and we hope you are learning as well.

Get Pattern Finder, join the trading community, and more, below:

Thanks for reading, friends.

Thank for all you do!